Tether Unveils Gold-Backed Token: 7.7 Tons Secure $770M XAUT

Introduction

When you think of gold, you probably imagine shiny bars locked away in a vault. And when you think of crypto, you might picture digital coins floating in cyberspace. But what if I told you that someone just built a bridge between these two worlds? Tether has done exactly that. They’ve officially released their first gold token attestation, confirming that their gold-backed cryptocurrency, XAUT, is secured by 7.7 tons of real gold.

Sounds impressive, right? But what does it mean for you, for crypto, and for the future of digital assets? Let’s dive into it — and don’t worry, I’ll keep it simple and easy to follow!

1. What Is Tether?

Before we jump into the gold, let’s talk about Tether itself.

Tether is like the anchor of the wild crypto ocean. While most cryptocurrencies jump up and down like a rollercoaster, Tether (often called USDT) stays steady, tied to real-world assets like the U.S. dollar. Now, they’re tying part of their future to gold too.

2. A Quick Look at XAUT (Tether Gold)

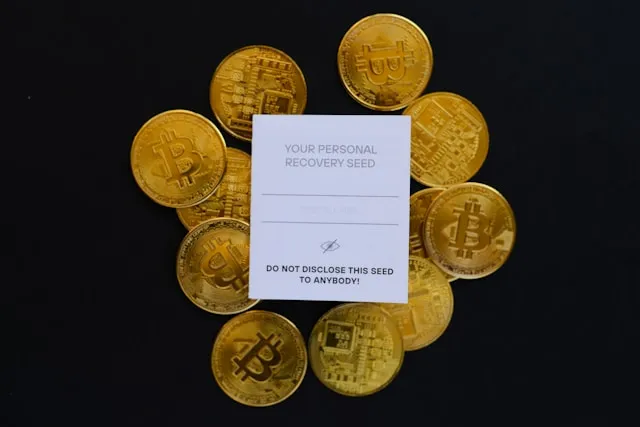

XAUT stands for Tether Gold. Think of it like a digital certificate that says, “Hey, I own a piece of real, shiny gold stored safely in a vault.” Instead of carrying gold bars around, you hold a digital token that represents them.

3. What Does ‘Attestation’ Mean?

You might be wondering: what is an attestation anyway?

Imagine a trusted third party checking under the hood of a car and confirming it’s got a real engine inside. That’s what attestation does — it’s an independent check that says, “Yes, the gold really exists.”

4. The Big Reveal: 7.7 Tons of Gold

Tether didn’t just back a few gold coins. They’ve secured 7.7 tons of physical gold — enough to make a small mountain! This gold supports their $770 million worth of XAUT tokens currently out there.

To put it into perspective: that’s roughly the weight of 62 average-sized elephants in pure gold.

5. Why This Attestation Matters

Trust is everything in crypto. We’ve seen projects collapse when people stop believing in them. This attestation shows that Tether is serious about transparency, and that’s a huge step toward building confidence.

It’s like getting a warranty on a brand-new car — you feel safer knowing it’s officially checked and approved.

6. How Tether’s Gold Token Works

Here’s the simple breakdown:

Each XAUT token equals one troy ounce of gold.

Tether stores this gold in Swiss vaults.

When you own XAUT, you technically own real gold without the hassle of storage or security.

No heavy lifting, no vaults, no worries.

7. Comparing XAUT to Regular Gold Ownership

Owning traditional gold means:

Storing it safely (which can be expensive).

Insuring it.

Worrying about theft.

Owning XAUT means:

Holding gold digitally.

Instant transactions.

No storage or insurance stress.

It’s like moving from carrying physical movie DVDs to just streaming Netflix.

8. Tether’s Growing Role in Crypto Stability

Tether already plays a big role in the crypto world by offering a “safe harbor” during market storms. Now, with gold tokens, they’re doubling down on providing real-world asset backing to digital currencies.

It’s a bold move that could set a trend for others.

9. What This Means for the Crypto Market

The crypto market loves innovation — and also craves stability. Tether’s gold move gives people a new, safer option to park their money during turbulent times.

It’s like building a sturdy bridge during a flood — when the waters rise, people need somewhere safe to cross.

10. The Benefits of Gold-Backed Crypto

Here’s why this matters:

Real Asset Support: You’re tied to something tangible.

Inflation Hedge: Gold has always been a safe investment during economic downturns.

Global Access: Anyone with an internet connection can own gold now.

It’s opening up new opportunities for millions around the world.

11. Potential Risks You Should Know About

Nothing is 100% risk-free. Potential concerns include:

Vault Security: Trusting the vault’s protection.

Regulatory Risks: Different countries might impose regulations on asset-backed tokens.

Market Volatility: While gold is stable, token trading can still swing.

Always do your research and invest wisely.

12. How Tether’s Move Affects Other Stablecoins

Tether just raised the bar. Other stablecoins like USDC or DAI might now feel the pressure to also offer asset-backed innovations or improve their transparency.

Competition in crypto means better choices for everyone.

13. Investor Reaction and Public Trust

So far, the reaction has been positive. Investors are excited to see real-world proof backing digital assets.

It’s a reminder that in crypto — like in life — seeing is believing.

14. Looking Ahead: What’s Next for Tether?

This gold-backed move is just the beginning. Tether could explore:

Backing tokens with other real assets like real estate.

Expanding into new regions.

Offering more transparency updates regularly.

The possibilities are wide open.

15. Final Thoughts: Gold, Crypto, and the Future

Bridging the old world (gold) and the new world (crypto) isn’t easy, but Tether is leading the way. By securing real gold for its tokens, Tether is proving that trust, innovation, and stability can coexist.

If you ever thought crypto was just a fad, moves like this show it’s building deeper roots every day.

FAQs

1. What is Tether Gold (XAUT)?

Tether Gold (XAUT) is a cryptocurrency backed by real physical gold, allowing users to own gold in a digital form without handling the physical metal.

2. How much gold backs the XAUT tokens?

Tether’s XAUT tokens are backed by 7.7 tons of physical gold stored in Swiss vaults, supporting around $770 million worth of tokens.

3. Why is the attestation important for Tether’s gold token?

The attestation provides independent verification that real gold backs the XAUT tokens, increasing transparency and investor trust.

4. How can I buy Tether Gold (XAUT)?

You can purchase XAUT through popular crypto exchanges that list the token, often using other cryptocurrencies or fiat currencies.

5. Are there risks in investing in Tether’s gold token?

Yes, risks include potential vault security breaches, changing regulations, and the general market risks involved in trading any cryptocurrency.

learn: Exploring LessInvest Crypto: Your Gateway to Smarter Cryptocurrency Investments