Bitcoin Alternative Asset Wins: Small Steps Matter – 2025

In a world racing toward financial innovation, Bitcoin continues to stand at the crossroads of disruption and legitimacy. A recent insight from a senior Bloomberg analyst adds a thought-provoking layer to this narrative — Bitcoin doesn’t just need massive leaps; it needs small, consistent wins to become a true alternative asset.

But what exactly does that mean? And how can those small wins reshape the future of finance as we know it?

Let’s break this down, step by step.

🚀 The Growing Spotlight on Bitcoin

Bitcoin is no longer a fringe digital asset whispered about in online forums. It’s now front and center in the global financial conversation. Yet, despite its meteoric rise in price and popularity, Bitcoin still faces skepticism when it comes to being considered a “real” alternative to traditional assets like gold or bonds.

🎯 What Did the Bloomberg Analyst Say?

According to the Bloomberg analyst featured in The Crypto Basic’s article, Bitcoin’s journey to becoming a mainstream alternative asset won’t happen overnight. Instead, it’s a gradual process — one that depends on a series of smaller, confidence-building victories.

“Bitcoin doesn’t need to conquer the world in a day. It just needs to consistently show up, deliver, and prove its value,” the analyst noted.

💡 Why Small Wins Matter in the Crypto World

Trust is Built Brick by Brick

Unlike traditional finance, crypto doesn’t have centuries of history to fall back on. That means trust has to be earned — and that happens in small, incremental steps.

Regulatory clarity in major markets

Adoption by payment processors

Integrations with traditional finance tools

Strong security measures

Consistent network uptime

Each of these is a small win — and together, they form the foundation of long-term credibility.

Think of Bitcoin Like a New Athlete

Picture this: a rookie basketball player walks onto the court. He doesn’t need to drop 50 points in his first game. What he does need is consistency — hit the open shots, make good passes, hustle on defense. That’s Bitcoin right now. We don’t need a miracle. We need the fundamentals.

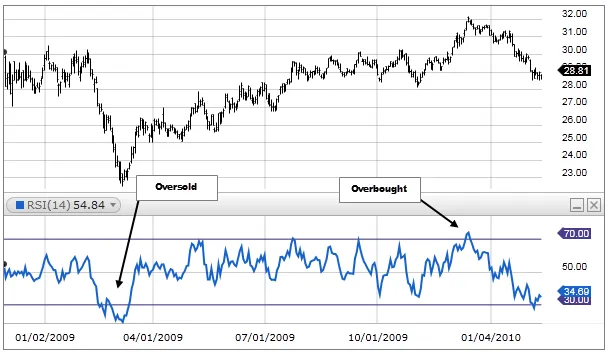

📈 Bitcoin’s Recent Performance: Not Just About Price

Stability Over Hype

Sure, Bitcoin’s price rallies make headlines, but its price alone isn’t the full story. What analysts are really watching is how Bitcoin handles pressure — during global banking instability, inflation spikes, and policy shifts.

Real-World Use Cases Are Emerging

We’ve moved past just speculation. In many parts of the world, Bitcoin is already being used as a hedge against inflation or as a store of value where banking systems are failing.

Argentina and Turkey are prime examples

Remittances using Bitcoin are on the rise

Merchants accepting BTC in emerging economies

🏦 Institutional Adoption: A Series of Small Wins

Wall Street’s Slowly Warming Up

Remember when banks scoffed at Bitcoin? That era is fading fast. Institutional adoption isn’t about a single billion-dollar investment. It’s about a growing number of firms allocating a small percentage of their portfolios to Bitcoin.

Fidelity offering Bitcoin custody

BlackRock launching a Bitcoin ETF

JPMorgan exploring blockchain infrastructure

Each move, though small individually, signals increasing comfort and trust.

ETFs Are Game Changers

ETFs (Exchange-Traded Funds) have brought Bitcoin to mainstream investors without the friction of wallets and private keys. This opens the door for 401(k) accounts, pension funds, and average investors to join the movement.

⚖️ Regulation: Not the Enemy, But the Key

Clarity Is a Catalyst

One of the biggest roadblocks for Bitcoin is regulatory uncertainty. Ironically, good regulation is not a threat — it’s an enabler. It’s a green light for large financial institutions to step in confidently.

Clearer tax rules = more adoption

Anti-money laundering measures = more legitimacy

Defined legal status = more utility

Small Wins in Legislation

We’ve seen crypto bills progress in countries like the U.S., UK, and UAE. These aren’t sweeping changes yet — but they’re pointing toward a more crypto-friendly future.

🛠️ Technology Matters: Bitcoin’s Infrastructure Is Evolving

Layer 2 Solutions Add Speed

Ever heard of the Lightning Network? It’s one of Bitcoin’s best small wins — enabling faster, cheaper transactions. While it’s not perfect yet, it’s a solid step toward scalability.

Taproot Upgrade = Bigger Possibilities

In 2021, the Taproot upgrade gave Bitcoin more privacy and smart contract functionality. It’s not flashy, but it’s essential groundwork for future innovation.

📊 Bitcoin vs Gold: The Digital Asset Debate

Battle of the Safe Havens

Gold has long been the go-to hedge. But in a digital world, Bitcoin is now seen as “digital gold.”

Let’s compare:

| Feature | Gold | Bitcoin |

|---|---|---|

| Portability | Low | High |

| Divisibility | Low | High |

| Verification | Manual | Instant |

| Scarcity | Known | Known |

| Volatility | Low | High |

Bitcoin’s not replacing gold — but it’s carving out its own lane.

📣 Public Perception and Media: The Role of Narratives

Media Drives Sentiment

Every time a major outlet reports positively on Bitcoin, it chips away at old narratives. The Bloomberg analyst’s comment is a perfect example — it’s subtle, but it carries weight.

Education Over Speculation

The crypto space needs more explainers and fewer hype videos. People need to know:

What is Bitcoin?

Why does it matter?

How can it be used safely?

That’s where real adoption begins.

🧠 Psychological Shifts: Changing the Way We Think About Money

Gen Z and Millennials Lead the Charge

Younger generations are more open to decentralized finance. For them, Bitcoin isn’t weird — it’s natural. Mobile-first, borderless, and digital-native? That’s how they live.

Trusting Code Over Institutions

Many folks now trust an open-source protocol over opaque banks. That’s a massive mindset shift, and one of Bitcoin’s quietest — but most powerful — wins.

🌍 Bitcoin’s Global Reach: A Borderless Asset

Bitcoin isn’t just a U.S. story. It’s being used in:

Africa for microfinance

Asia for international trade

Latin America for inflation hedging

These real-world use cases are Bitcoin’s resume. The more it’s used, the stronger it becomes.

📉 Challenges Still Remain: Let’s Be Real

Volatility Is a Hurdle

Bitcoin’s price swings still scare off traditional investors. But over time, with wider adoption, we could see that stabilize.

Education Gaps Must Be Closed

Many people still think Bitcoin is “internet magic money.” We’ve got to bridge that knowledge gap for mainstream adoption to stick.

📌 Final Thoughts: Small Wins, Big Future

Bitcoin doesn’t need to take over the world tomorrow. It just needs to keep showing up, solving real problems, and proving its worth. If it can stack up enough small wins — in adoption, regulation, perception, and technology — it can truly stand as a legitimate alternative asset.

Like climbing a mountain, every small step takes us closer to the summit.

❓ Frequently Asked Questions (FAQs)

1. Why does Bitcoin need small wins to succeed?

Small wins build trust, establish use cases, and drive incremental adoption, which are crucial for long-term legitimacy.

2. What are some examples of Bitcoin’s small wins?

Examples include regulatory clarity, institutional interest, tech upgrades (like the Lightning Network), and real-world usage in inflation-hit countries.

3. Is Bitcoin really a good alternative to gold?

Yes, Bitcoin shares traits with gold like scarcity and store of value, but it’s more portable, divisible, and easier to verify.

4. How does institutional adoption impact Bitcoin?

It legitimizes Bitcoin, reduces volatility over time, and brings in large capital, all of which support its growth as an asset.

5. What are the biggest challenges for Bitcoin in 2025?

Volatility, regulatory uncertainty, misinformation, and technical complexity remain key hurdles to mainstream adoption.

One Comment

Comments are closed.